A New Hampshire small estate affidavit is a document that allows an individual to waive the administration process of a decedent’s estate. New Hampshire does not recognize an affidavit specifically suited to settling small estates per se; however, certain estates may be closed without the accounting, inventorying, and fiduciary bonds usually required when distributing a decedent’s property and assets. In these cases, a “Waiver of Administration,” is filed which serves a similar purpose to a small estate affidavit in other states.

An estate may only qualify for a waiver of administration under certain circumstances, including the absence of debt, and if certain beneficiaries are present.

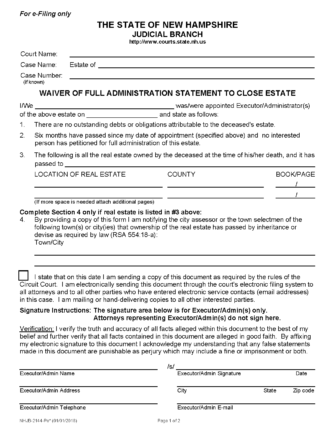

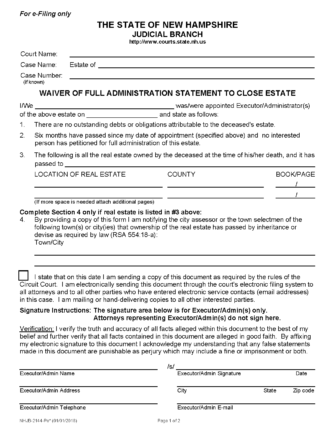

A Waiver of Full Administration Statement to Close Estate (Form NHJB-2144-Pe*) may only be used if there is no other petition already made for full administration of the estate. Furthermore, the sole beneficiary or heir and appointed executor/administrator must be one of the following (in order of priority):

The Petition for Estate Administration (Form NHJB-2145-Pe) will open a case for the estate. The form will let the court know the petitioner (the heir or beneficiary) is requesting to be estate executor/administrator and be granted a waiver of administration.

The filing must be done online, and the filing fees can be paid at the end of the online filing process or in court (a fee waiver may also be requested in the online filer).

Select the option under “Circuit Court Attorneys” if the petitioner is working with an attorney, or “Self-Represented Parties and other Non-Attorney Filers” if the petitioner is representing themselves. Create an account, then follow the prompts to file the petition and request a Waiver of Administration.

After the petition is submitted online, the original will (if applicable) and all codicils, and certificate of death must then be mailed to:

Estates Electronic Filing Center,

2 Charles Doe Drive, Suite 2,

Concord NH 03301.

Once the filing center has received the required documents, the court will notify all interested parties (e.g., potential heirs, creditors, etc.). The clerk will publish a notice that the executor/administrator has been appointed in a newspaper from the town or city where the decedent resided as outlined in § 550:10 and § 553:16 (doesn’t apply if the estate’s total value is $10,000 or less ).

If the court accepts the petition, they will issue a Certificate of Appointment certifying the petitioner as the estate executor/administrator.

Once the petitioner is appointed as estate executor/administrator, they may inherit the estate as the sole heir without needing to prepare an inventory or accounting of assets. They must ensure the estate has no outstanding debts or obligations before filing the waiver in the next step.

The Waiver of Administration should be filed once the executor/administrator is ready to close the estate. It must be completed and filed between six (6) and twelve (12) months after the date on the executor/administrator’s Certificate of Appointment.

The Waiver of Full Administration Statement to Close Estate can only be filed online; however, exceptions for in-person filing are granted by the court for extreme circumstances.