If you knowingly report inaccurate data on a credit application, you’re committing fraud. And while a credit card issuer might not immediately request verification, legally it's possible.

Updated Jun 29, 2023 11:48 a.m. PDT · 2 min read Written by Erin El Issa Senior Writer Erin El Issa

Senior Writer | Data analysis, personal finance, credit cards

Erin El Issa writes data-driven studies about personal finance, credit cards, travel, investing, banking and student loans. She loves numbers and aims to demystify data sets to help consumers improve their financial lives. Before becoming a Nerd in 2014, she worked as a tax accountant and freelance personal finance writer. Erin's work has been cited by The New York Times, CNBC, the "Today" show, Forbes and elsewhere. In her spare time, Erin reads voraciously and tries in vain to keep up with her two kids. She is based in Ypsilanti, Michigan.

Co-written by Kenley Young Assigning Editor Kenley Young

Assigning Editor | Credit cards, credit scores

Kenley Young directs daily credit cards coverage for NerdWallet. Previously, he was a homepage editor and digital content producer for Fox Sports, and before that a front page editor for Yahoo. He has decades of experience in digital and print media, including stints as a copy desk chief, a wire editor and a metro editor for the McClatchy newspaper chain.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When you apply for a credit card , the application will ask you a number of questions, ranging from your Social Security number and income to your employment status, rent or mortgage payment, and more.

If you knowingly report inaccurate data on a credit card application, you’re committing fraud, the penalties for which can include seven figures' worth of fines and/or decades of imprisonment.

While credit card companies often will not ask for verification of things like income, legally they can. And either way, lying on a credit card application could come back to bite you, especially if you end up overextending yourself on the card.

Typically, a credit card application will require that you check a box to attest that, to the best of your knowledge, you're supplying accurate information.

By federal law , lenders cannot extend credit to someone without first determining that the applicant has the ability to make payments, which is why credit card applications ask for things like your income, employment information, and what you pay in mortgage or rent.

The credit card company might not ask for verification of such information, at least not immediately. And the truth is, large discrepancies are much more likely to raise red flags than "fudging." For example, if you claim $10,000 of income on your tax return and $90,000 of income on your credit card application, you have a better chance of getting caught than if you claim $10,000 and $12,000, respectively.

But the application and underwriting process for credit cards has grown ever more sophisticated over time, and lenders — especially ones that you already have accounts with — can much more easily ferret out problematic data when you apply.

There's also nothing preventing a lender from periodically reviewing your account even after you've been approved.

Ready for a new credit card?Nerdwallet+ members can earn $100 in rewards for paying their first bill on time with an eligible credit card.

GET STARTED

Lying on a credit card application can be a costly mistake, as it constitutes fraud and can result in up to $1 million in fines and/or 30 years in prison.

In 2012, a man was convicted of bank loan application fraud after being accused, years earlier, of reporting $12,488 of income to the IRS and $90,000-$122,000 of income on multiple credit applications. While he wasn’t fined $1 million or sentenced to 30 years in prison, he did have to pay a fine of almost $50,000 and was sentenced to time served and supervision upon release.

And keep in mind that while a lie may not be discovered immediately, it's possible it could haunt you later. After all, if you feel the need to lie on a credit card application, it’s likely because such a product doesn’t fit into your budget. And if you're unable to manage a high credit limit responsibly, it can quickly spiral into a mountain of expensive debt. ( Credit card APRs are routinely in the double digits.)

It can get worse than that, too. If you're so buried in debt that bankruptcy becomes your only option, then credit card issuers and other banks will work to determine why it is that you're unable to pay. They'll require tons of data and documents from you, and that information could lead to legal woes if it doesn't corroborate what you stated on your initial application.

It's possible that by falsely inflating your income or claiming to be employed when you aren’t, you might secure a credit card approval or a larger credit line. But honestly, it's not worth the potential risk.

If you need access to a credit card but don't think you meet income or other requirements, consider other options, such as:

A secured credit card: Secured credit cards are easier to get for those with low income or bad credit — FICO scores of 629 or lower — because they require that you put down a security deposit as collateral, which lessens the risk to the issuer. That deposit becomes your credit line, and after a period of time of responsible use, you may be eligible to upgrade to a traditional unsecured credit card with a higher limit (and get your deposit back).

Becoming an authorized user: When a loved one or someone that you trust adds you as an authorized user to their credit card, you're able to use their account to make purchases. (You even get your own card with your name on it.) You're not liable for those purchases, though, as that responsibility falls to the primary user who added you. In some cases, if the primary user already has good credit, your own credit could benefit, too.

Report your income, debt, employment status and housing costs correctly on your credit card application. Chances are, your lender won’t verify these items. But it has every right to, and if it does, you could end up in big trouble.

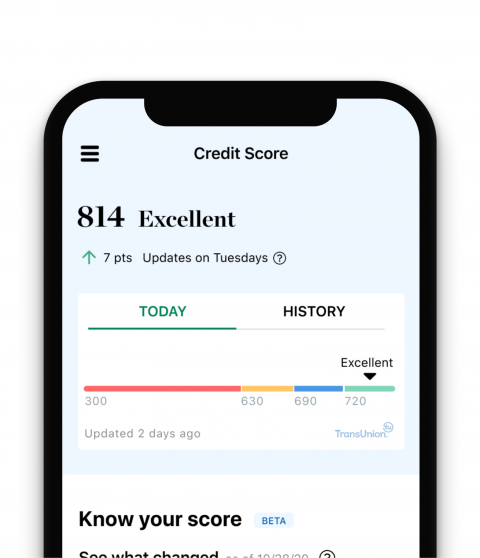

Find the best card for your credit Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

You’re following Erin El Issa

Visit your My NerdWallet Settings page to see all the writers you're following.

Erin El Issa is a credit cards expert and studies writer at NerdWallet. Her work has been featured by USA Today, U.S. News and MarketWatch. See full bio.

You’re following Kenley Young

Visit your My NerdWallet Settings page to see all the writers you're following.

Kenley is an assigning editor at NerdWallet covering credit cards. He has worked for Yahoo and FoxSports.com as an editor and producer. See full bio.

On a similar note.

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet™ | 55 Hawthorne St. - 10th Floor, San Francisco, CA 94105